Pa Quarterly Tax Payment Forms 2024

Pa Quarterly Tax Payment Forms 2024. You can make your quarterly. Locate and download forms needed to complete your filing and payment processes.

Locate and download forms needed to complete your filing and payment processes. If you estimate your tax to be $500 for the 2023 taxable year, you should make your payment of $500 by april 15, 2024).

Without Logging In, From The Mypath Home.

To get started, refine your search using the search settings below.

The Final Quarterly Payment Is Due January 2025.

If you estimate your tax to be $500 for the 2023 taxable year, you should make your payment of $500 by april 15, 2024).

Pa Quarterly Tax Payment Forms 2024 Images References :

Pa Quarterly Tax Payment Forms 2024 Kally Marinna, You can electronically make your estimated payments online through. Payments can be made via.

Source: kimberleywdode.pages.dev

Source: kimberleywdode.pages.dev

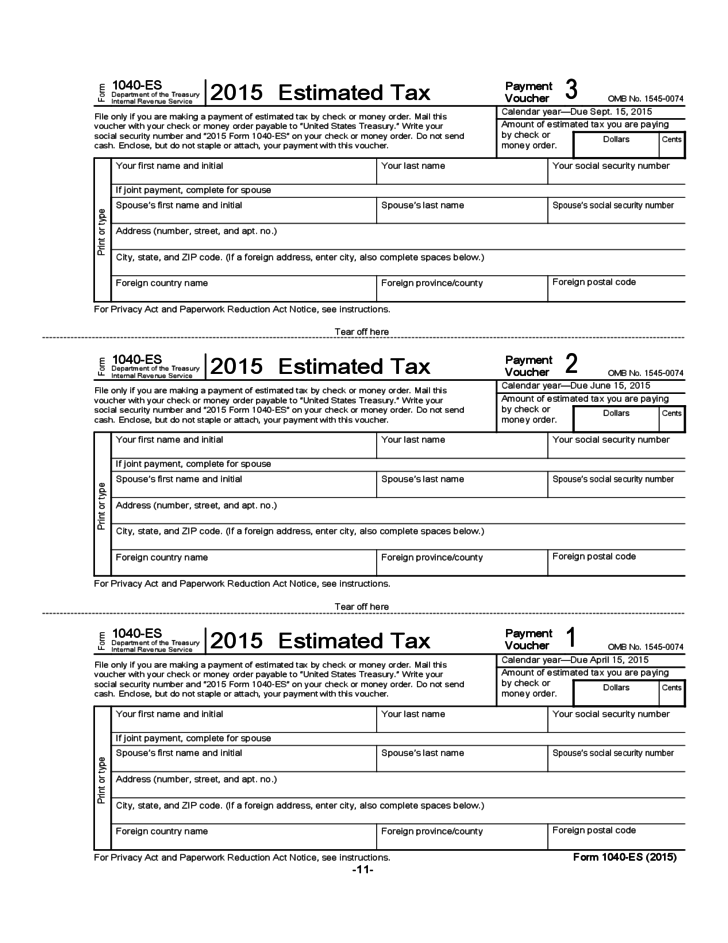

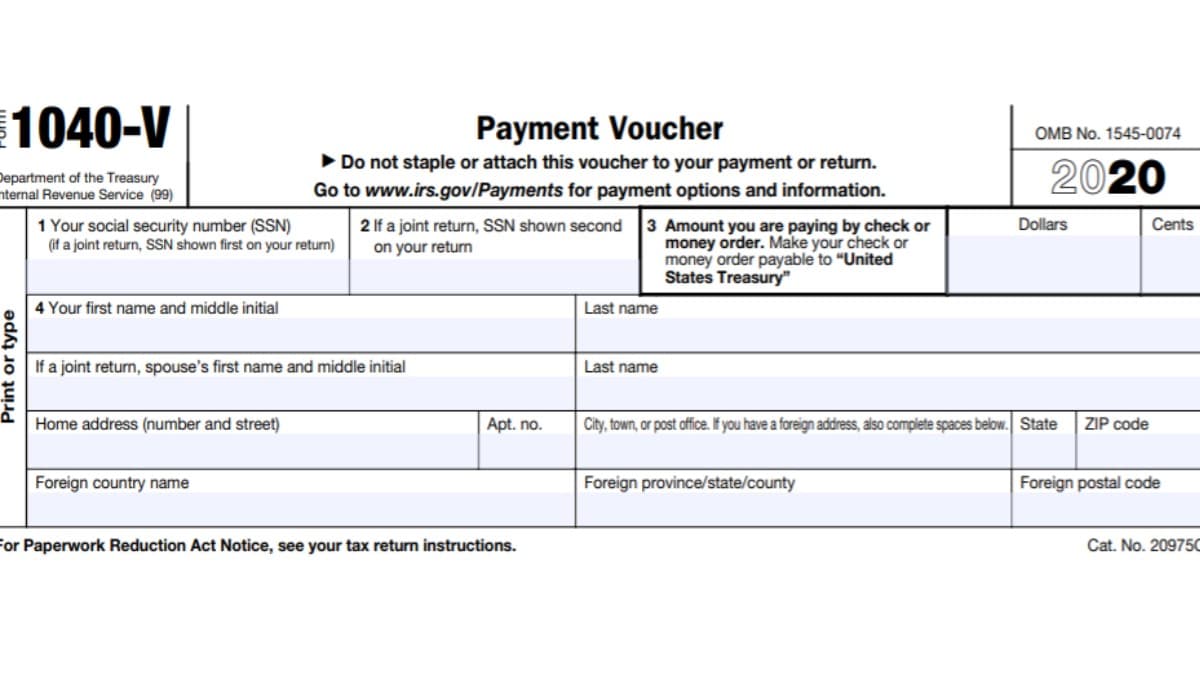

Irs Forms Estimated Taxes 2024 Kaela Ermentrude, The final quarterly payment is due january 2025. The department of the treasury (treasury department) and the irs will publish for public availability any comments submitted to the irs’s public docket.

Source: carleeqhollyanne.pages.dev

Source: carleeqhollyanne.pages.dev

Irs Estimated Tax Payments 2024 Forms Luz Stepha, Payments can be made via. The final quarterly payment is due january 2025.

Source: dollbwaneta.pages.dev

Source: dollbwaneta.pages.dev

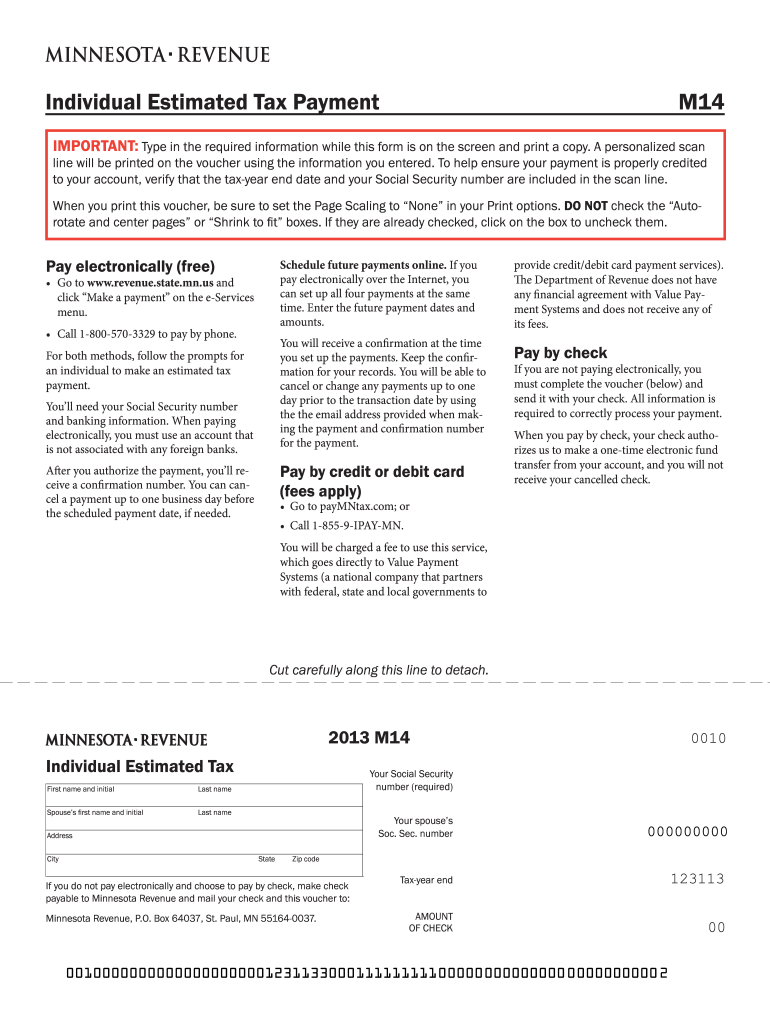

Pa Quarterly Tax Payment Forms 2024 Dode Carlotta, Payments can be made via. Depending on the volume of sales taxes you collect and the status of your sales tax account with pennsylvania, you may be.

Pa Estimated Tax Payments 2024 Forms Lyndy Rosina, In 2024, estimated tax payments are due april 15, june 17, and sept. To get started, refine your search using the search settings below.

Source: www.formsbank.com

Source: www.formsbank.com

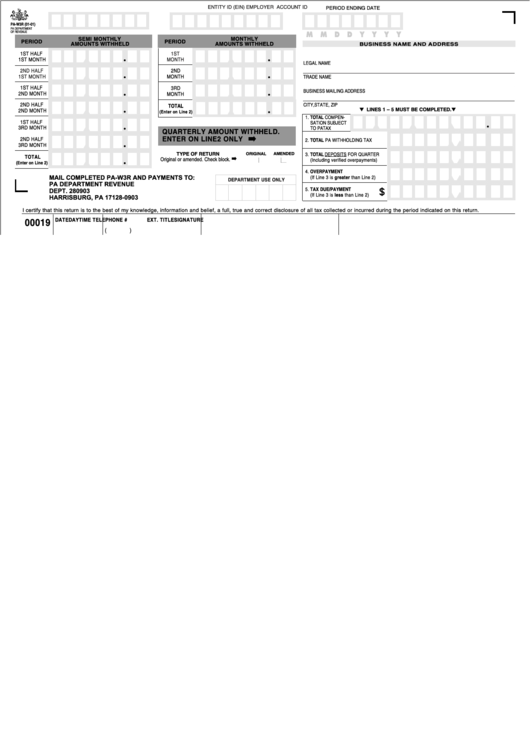

Form PaW3r Employer Quarterly Reconciliation Return Of Tax, The final quarterly payment is due january 2025. Please complete the change in business status form.

Source: www.dochub.com

Source: www.dochub.com

Pa tax forms Fill out & sign online DocHub, Need to change or update your business information? Without logging in, from the mypath home.

Source: www.formsbank.com

Source: www.formsbank.com

Instructions For Completing Pa Uc Quarterly Tax Forms printable pdf, In 2024, estimated tax payments are due april 15, june 17, and sept. Please complete the change in business status form.

Source: roseliawivett.pages.dev

Source: roseliawivett.pages.dev

Quarterly Tax Forms 2024 Ynez Analise, Payments can be made via. Depending on the volume of sales taxes you collect and the status of your sales tax account with pennsylvania, you may be.

Pa Estimated Tax Payments 2024 Dehlia Layney, You can electronically make your estimated payments online through. If you do not have the adobe acrobat reader on your computer please download it first because you will need this program to view and print our forms.

If You Estimate Your Tax To Be $500 For The 2023 Taxable Year, You Should Make Your Payment Of $500 By April 15, 2024).

File online with pa department of revenue.

The Quarterly Due Dates For Personal Income Tax Estimated Payments Are As Follows:

Pa schedule p, refund donations to pa 529 college and career savings program accounts.

Category: 2024